However, with the pre-market recovery pricing in a potential acquisition, is the margin of safety still adequate for investors sitting on the sidelines? PXD blended fair value estimate (InvestingPro) Of course, Pioneer and its energy peers received a massive boost from OPEC+'s decision to slash nearly 1.2M barrels per day recently to stem a further decline in crude oil prices. We urged investors in September to consider the opportunity to add exposure if PXD dips below the $200 level, which saw buyers return with high conviction over the past few weeks. A successful acquisition could lift the combined entity to be the most significant Permian producer over Occidental Petroleum Corporation ( OXY) based on their combined total production of about 1.2M BOE per day in FY22.Īs such, investors who didn't capitalize on the recent steep decline to the $180 level have missed out on the recent recovery, as PXD recovered its losses from March over the past three weeks. Notwithstanding, it does highlight the high quality and depth of Pioneer's Permian assets. Accordingly, PXD is up more than 8% in pre-market at writing as investors assess the outcome of the talk. However, investors must note that the talks are still in the early stages and may not result in an acquisition, even though the market has attempted to price in the optimism. Keen investors should know that the WSJ ran an exclusive highlighting that XOM is in " preliminary talks with Pioneer Natural Resources about a possible acquisition." Notably, most of PXD's assets are located "in the core of the play," which likely attracted the attention of Exxon Mobil Corporation ( XOM ) recently. Pioneer acquired most of its acreage " at an average cost of around $500 per acre." As such, it gives the company a significant cost advantage against its peers, resulting in industry-leading operating performance metrics.

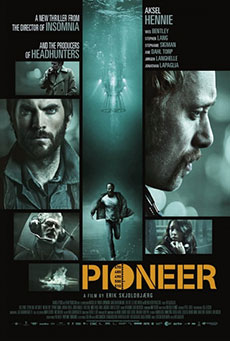

#Pioner pictures free

It has deep inventory in the region and is sitting on " about 30 years of premium inventory." In addition, the company highlighted its leading acreage quality, which produced more free cash flow, or FCF, per barrel of oil equivalent, or BOE, in 2022 over its leading peers. Investors new to Pioneer should know that the company is the largest independent E&P producer in the Permian Basin. We last covered Pioneer Natural Resources Company ( NYSE: PXD), or Pioneer, in September 2022, when we urged investors to remain patient.

0 kommentar(er)

0 kommentar(er)